Hello, Pomelo

(Originally published on Substack. Subscribe there for email updates!)

I’m excited to share that earlier this year, I joined an early-stage startup named Pomelo as VP of Engineering — and we just launched!

Pomelo as a product and idea is brilliant. But first, some background.

Millions of immigrants live in the US and regularly send money back home to their families. These money transfers, called “remittances”, total ~$150B per year from the US alone.1 🤯

To send money home today, immigrants have to use traditional remittance services, which charge hefty transfer fees and exchange rate markups. The World Bank and the UN have found that remitters lose 6-7% — that’s ~$10B/year! — to these costs.2 😰

Some immigrants even physically carry large amounts of cash back home, e.g. using backpacks with false compartments, to save on these costs. (I’ve now learned that multiple people in my own network do this!)

Enter Pomelo. We just launched a whole new way for immigrants to share money with their families back home — for a fraction of the cost.

We do this using the power of credit. Instead of sending cash overseas, our Pomelo Card™ lets remitters share access to credit. Specifically:

- Remitters sign up for our Pomelo Card here in the US. We offer both “secured” and “unsecured” cards, so everyone can qualify, regardless of credit history or income.3 (This makes us a great way for immigrants to build credit in the US!)

- Remitters then add their families abroad as authorized users on their cards. Remitters can set fine-grained spending limits per family member and pause/unpause cards at any time.

- Their families use their cards to pay for expenses (like groceries, dining, and online shopping) anywhere that Mastercard is accepted. We both mail physical cards abroad and provide instant “virtual” cards for mobile and online use.

- Remitters pay the bill here in the US. They also pay only after any money has been spent, not before. This protects both remitters and their families against theft, fraud, and other unauthorized use — which cash can’t do.

This works similarly to adding authorized users to your credit cards here in the US, but we’ve done the work to (a) enable this internationally, (b) eliminate transfer and transaction fees, and (c) provide one of the best exchange rates on the market today.4

Finally, the way we make most of our money (like most credit cards) is through interchange: instead of charging our customers fees, merchants and banks pay us a portion of every transaction. This puts money — hopefully billions of dollars one day! — back into the hands of remitters and their families who need it most.

The result: instead of sending $500 home in cash every month for up to $35 each time, remitters can now share $500 in credit — with safety, transparency, and control — for just $1 today.5 🤩

This idea sounds simple, and — like many great ideas in hindsight — it is. But it’s required a lot of “schlep work” to make it real, like signing key business partnerships, setting up proper compliance programs and controls, and building several new technical integrations that have never existed before.

I’m excited by this combination of a simple idea in theory that’s non-trivial to execute in practice.

The credit for the idea goes, of course, to our visionary founder and CEO, Eric Frenkiel. If you’re interested in learning more about his founding story and our broader vision, check out his own launch blog post and this TV interview of him:

What energizes me most, though, isn’t just the idea — it’s the concrete customer feedback we’re getting. We just launched in the Philippines, and these are real customer quotes from our early adopters so far:

We even have our first customer unboxing video now! 😃

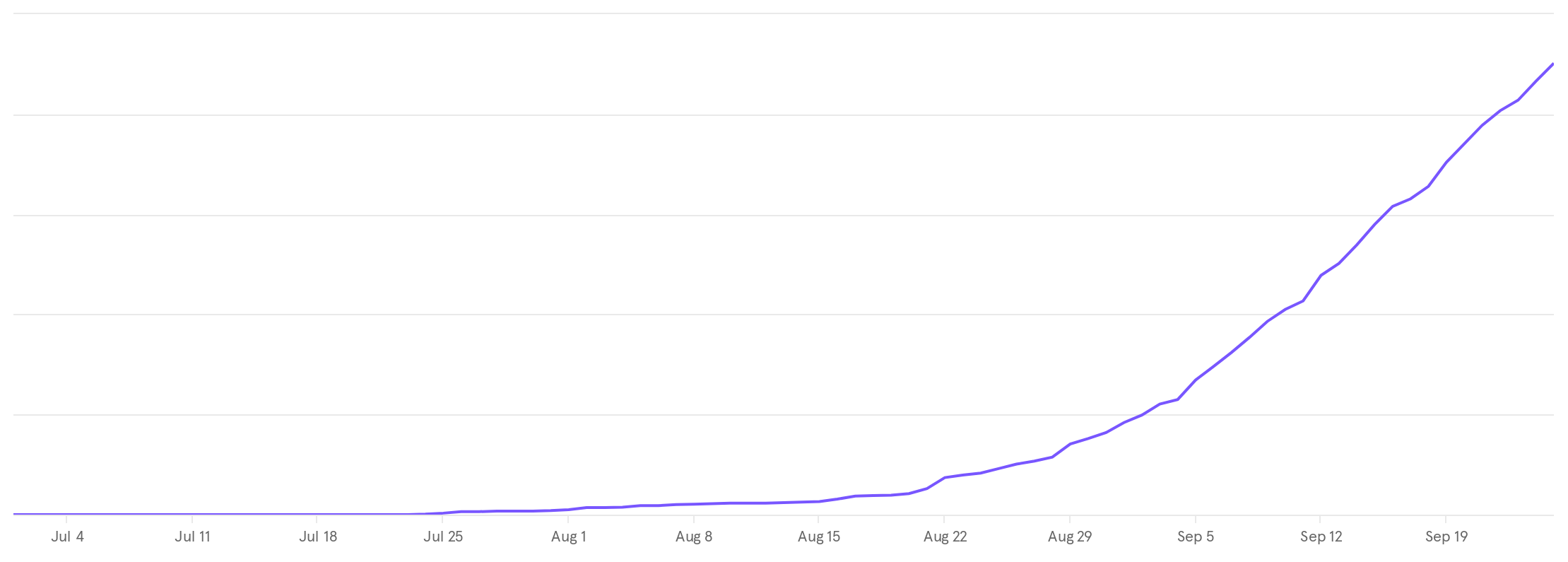

And we’re seeing traction through quantitative data, too. This is a chart of our total transaction volume (after months of hard work on our funnel and fulfillment), and many of our other key metrics are starting to look like this now, too.

We still have so much more to figure out and build and improve, but it feels extremely energizing to be building something that’s both so helpful to our customers and so loved by them. ❤️

There’s so much more here that I want to say about why else I joined and what else energizes me here. I’ll distill this to three more points:

-

The team. I have excellent colleagues who are not just capable, but also kind and hard-working. They also bring awesome and varied experience:

- Eric and our CFO previously built and grew another startup together that’s now worth >$1B.

- Our VP of Marketing was employee #8 at Remitly — another company in our space that IPO’ed at $7B last year — and is Filipino himself!

- Our VP of Product helped grow Affirm (as did our customer service lead), and shipped things millions of people still use at Twitter and Google before that.

- Our Chief Compliance Officer was also CCO at the startup that ultimately built the Apple Card.

- (We may have also just hired a lead designer from a well-known and well-loved neobank… but I don’t want to steal his thunder. 😉)

- The culture. I now seek companies that value both the “what” and the “how”. I want to achieve real, lasting impact and also love the journey along the way. The “how” that we value is holding ourselves to a high quality bar; being open to mistakes but committed to learning from them; hiring great people who aren’t just talented but also collaborative and empathetic; working as a team rather than as individuals; giving feedback directly and kindly, and receiving it graciously. Perhaps most notable to me is our passionate customer focus, where we broadcast real customer comments almost every day, and our full-company transparency, where we proactively and openly share almost everything.

- The work. We’re building something that’s never existed before, and we’re just getting started. We have to solve unique product problems, like conveying the nuances of charge cards to customers that have never encountered them before. We have to solve business and technical problems, like enabling frictionless UX and immediate delight without compromising on security or fraud. And we have to build an excellent company along the way to keep succeeding as we grow and scale. Work like this is why people join startups. I love having the opportunity to do that here, thanks to our traction and potential.

In each of my previous three startup experiences, I took something unique and valuable away. When I was looking for my next role, I really wanted to find a company that could bring those things together.

I wanted first and foremost to find a great, socially positive mission. (I really want to have a lasting positive impact on society.)

I wanted to find a company that had clear business potential. (I believe that building a big, sustainable business with the right, aligned incentives can be a great way to maximize that positive social impact.)

And I wanted to find a company that’d also be a great place to work (where I’d love the team and culture and work every day).

I was very excited to find this combination in Pomelo — and that’s why I joined.

Our early traction is now a cherry on top, and I’m pumped for our opportunity ahead.

If you’re as energized as me by everything above, I’m excited to announce that we’re hiring now! 🎉

We’re particularly excited to hire 3-4 more engineers over the next few months. Follow that link to learn more about our tech stack and what we’re looking for.

We’re fortunate to be in a recession-resistant industry, where remitters send even more money home during recessions.6 (Remittances aren’t frivolous expenses; their families are relying on the funds to live.) So unlike many companies today, our business is rapidly growing, not shrinking.

We’re also fortunate to be well-funded. Our two most notable investors to me are Kevin Hartz and Keith Rabois: Kevin co-founded Xoom, one of the most popular remittance services today, and Keith served on the board of Xoom. I love the expertise they bring in our space, and I’m excited that they (continue to) bet on Pomelo.

So while many other startups are contracting and preparing for a fundraising winter, we’re expanding and preparing for the winter holidays — the peak remittance season of the year. This is literally a great time to join us. 😎

—

Thanks for reading! If you have any questions about Pomelo, reach out. And if you or anyone you know sends money home to the Philippines, give us a try! I’d love to hear your experience and feedback.

I’m excited for us to achieve the impact we want to achieve, and I look forward to sharing more of our progress along the way. 😃

-

Sources: Center for Immigration Studies, Forbes ↩

-

Sources: World Bank, UN ↩

-

We of course reject suspected fraud, and we may change our requirements to qualify in the future. Banking services are provided by Coastal Community Bank, Member FDIC, and are subject to the terms of our Cardholder Agreement. The Pomelo Card is issued by Coastal Community Bank pursuant to a license from Mastercard International and may be used everywhere Mastercard is accepted. Pomelo, Inc. is a technology services provider and the administrator of the card program. ↩

-

We publish and keep up-to-date a comparison of our and our competitors’ exchange rates on our website. ↩

-

This $1 comes from a 0.2% exchange rate markup charged by Mastercard today. This cost may change over time! ↩

-

A powerful example of this was when the pandemic started in 2020. The World Bank predicted that remittances would decrease 20%, but they actually held steady in most cases and even increased 10% in some cases (e.g. to Mexico)! Source: The Conversation ↩